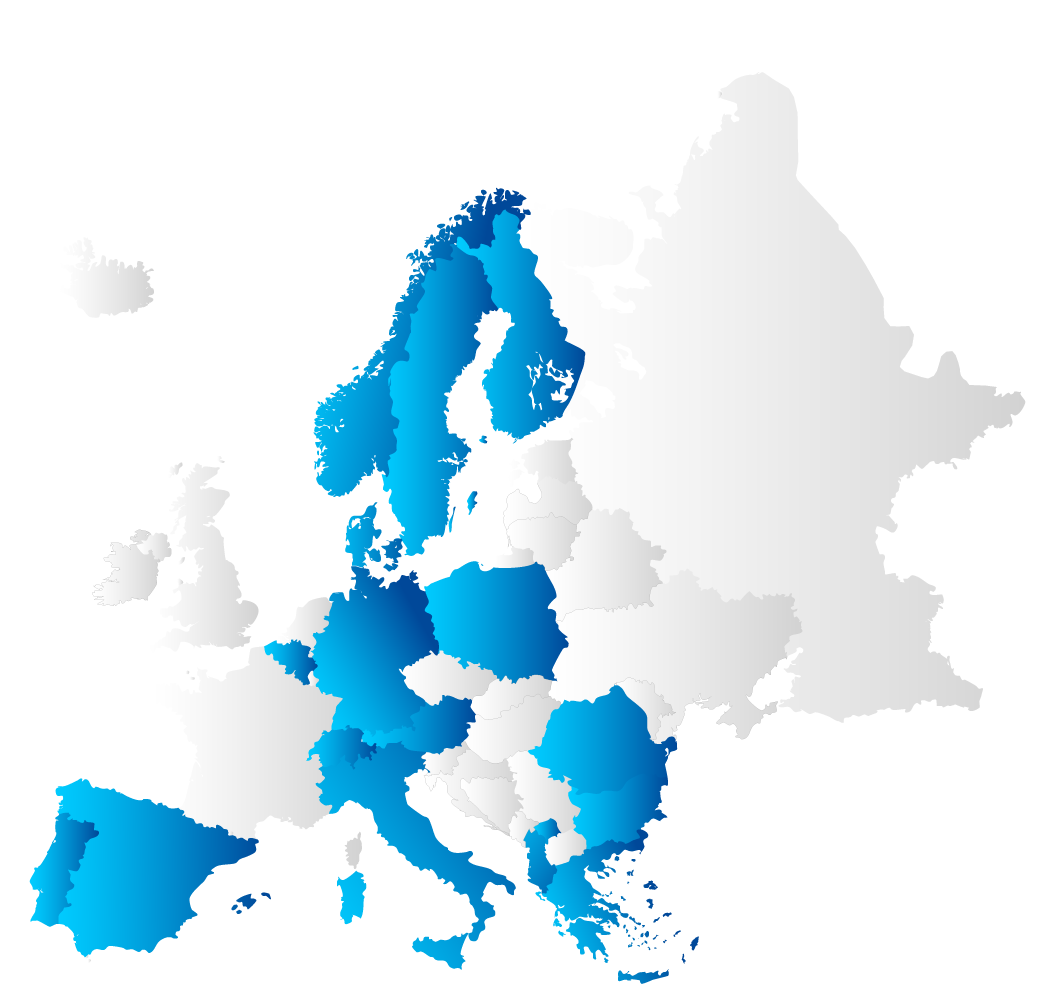

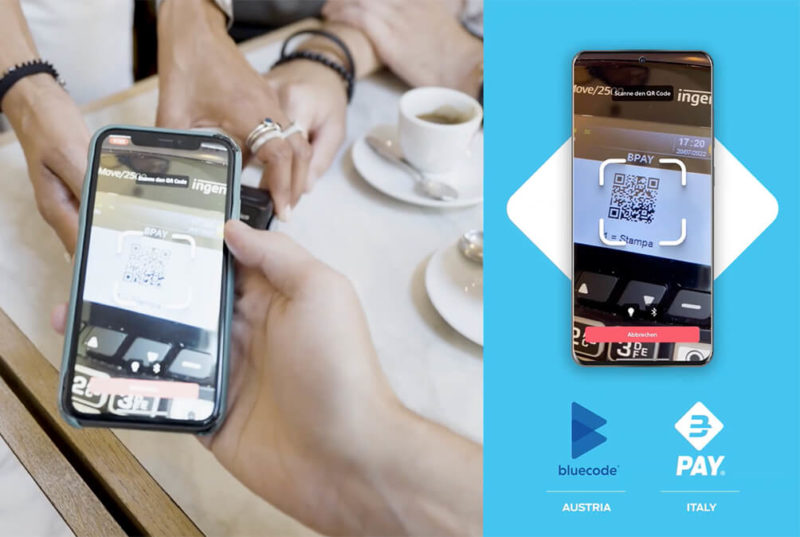

What if mobile payments worked seamlessly across all of Europe — secure, effortless, and truly connected? That’s not a “what if” — that is what we do at EMPSA. We are building a seamless, secure, and interoperable payment ecosystem that works across borders and platforms. The European Mobile Payment Systems Association (EMPSA) brings together 13 mobile payment systems that provide innovative payment services to more than 100 million users, more than 5 million merchant acceptance points, and hundreds of European PSP handling several billion transactions per year. EMPSA members represent strong, trusted brands among European consumers and merchants, and are building the future of payments in Europe, with a vision of enabling seamless mobile payment by providing roaming solutions among participating payment systems.

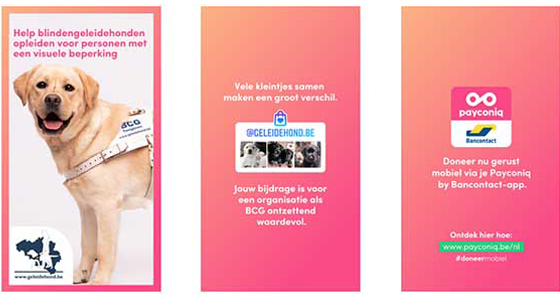

EMPSA members include BANCOMAT PAY (Italy), Bancontact Payconiq Company (Belgium), Bizum (Spain), BLIK (Poland, Romania, and Slovakia), BORICA AD (Bulgaria), Bluecode (Austria and Germany), DIAS S.A. (Greece) MB WAY by SIBS (Portugal), KUIK by MPAY (Albania), Swish (Sweden), RoPay by Transfond (Romania), TWINT (Switzerland) and VippsMobilePay (Denmark, Finland and Norway).